“Leaving the question of price aside, the best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return.” – Warren Buffet, 1992 Shareholders’ Letter.

Buffett’s phrase captures one of the most important secrets of investing: it is not profitability per se what matters, but the number of profitable future reinvestment opportunities.

As the future is uncertain, investing involves both art and science. The science involves determining the present value of our free cash flow forecasts with a specific discount rate. This is purely mechanical, and any calculator or spreadsheet can help. However, the beauty of investing is that every market participant has his or her own assumptions about the future of a business – from its competitive advantages to its customers’ loyalty. This is art, and as Charlie Munger says, it requires the ability to think across different spectrum of science simultaneously.

Estimating current profitability of a business is pretty simple: ROIC = NOPAT / Invested Capital (check out this paper, where Damodaran goes into detail and explains the differences against other metrics). However, as we have previously mentioned, the important thing (and what the market discounts) is not what is happening now, but what will happen in the future. We want to find profitable companies, but what we’re really concerned about is identifying the ROIIC (return on incremental invested capital).

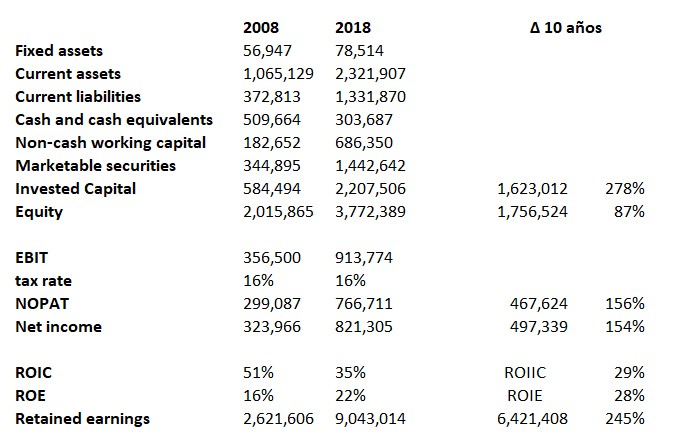

Let’s take Check Point Software (CHKP) as an example (USD figures). In 2018, CHKP generated $$766 M NOPAT with a $2.2 B invested capital, i.e., a 35% ROIC. This is very attractive, but we’re interested in finding out how capable they are of generating high rates of return through time. In hindsight, we can look at CHKP situation 10 years ago.

In 2008, CHKP generated $299 M NOPAT with $584 M invested capital. During the next 10 years, invested capital increased to $1.6 B (+278%), while NOPAT increased $467 M (+156%). This implied a 29% ROIIC, an extraordinary feat. An easier way to measure return on capital is using ROE (return on equity) – dividing net income over shareholders equity. CHKP’s 2008 ROE was 16%, whereas 2018 ROE stood at 22%, a 28% incremental ROE. (Net profits increased $497 M (+154%); equity increased $1.7 B (+87%)).

A company’s intrinsic value will grow at its ROIC times its capital reinvestment rate. The reinvestment rate is simply the portion of net income that remains after paying dividends or repurchasing shares (this information is found in the “Financing activities” section, within the Cash Flow Statement conversely, it is calculated as the year-on-year of retained earnings, within the Balance sheet). The formula is: Intrinsic Value Growth = ROIC (or ROE) * Reinvestment rate.

Something outstanding about CHKP is it does not pay dividends, so its intrinsic value growth tends to be equal to or very close to its ROIC (~97% due to share repurchases). On a related note, Munger has said: “Over the long-term, it’s hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6% return even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with a fine result.”

Munger is right. In hindsight, CHKP’s 2008-2018 return was +520%, a 20% compound annual growth rate (CAGR). Throughout 2008-2018, the company’s ROE was 19%. This reveals that, when investing, the important thing is to perceive future profitability of a business, and once we feel comfortable with its reinvestment opportunities, let the company and the magic of compounding do the trick.

Does this mean that buying low y and selling early is a flawed technique to make money? Absolutely not, Buffett made his fortune through buying and selling net-nets, which he called cigarette butts. The difference lies in being cautious when a business cannot generate sustainable and consistent returns on capital, as we’re expecting price will converge to its intrinsic value. The advantage in finding great companies that can reinvest huge amounts of capital at higher rates of return, is that we do not need to trade actively; we can increase our wealth as the company grows.

Every time we see a profitable business, we need to ask ourselves:

- What portion of net income are they reinvesting?

- At what rates are they reinvesting it?

If after analyzing the competitive environment, the company’s strengths, management quality, among other things, we come up with reasonably positive answers, good things could happen. In addition of being hard to find, we don’t really need a great number of stellar companies to invest; a handful will be enough to have an impact in our lives or our jobs… easy, right?

We are aware concepts like “NOPAT”, “ROIC” or “intrinsic value” can seem daunting. We want to help you better understand these and other financial and investment concepts. Feel free to inquire about our courses and advisory.

1 thought on “Future ROIC is what matters”