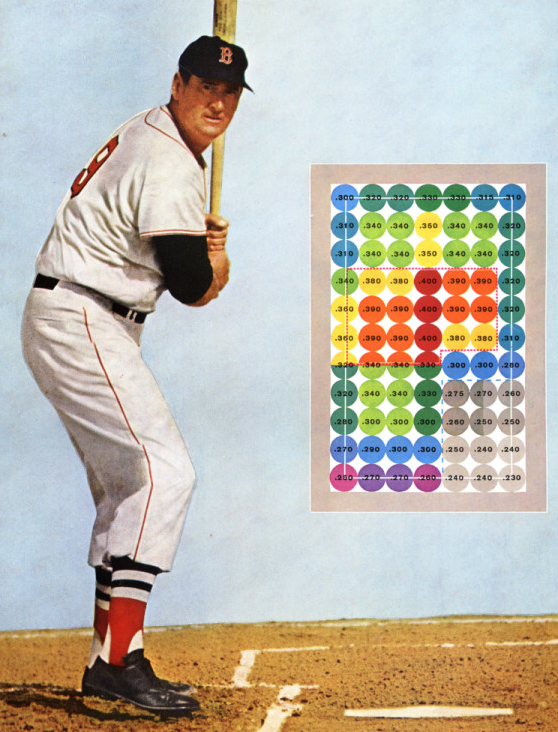

Warren Buffett has mentioned that the “market is there to serve us, not to instruct us” on several occasions. He has also made the analogy that, as investors, we are like a baseball player in front of a pitcher whose name is Mr. Market. The most important difference between a normal baseball game and the stock market is that we have the advantage that no one is counting how many times we decide not to swing the bat.

“The trick in investing is to watch pitch after pitch go by and wait for the one right in your sweet spot. And if people are yelling, ‘Swing, you bum!,’ ignore them…Defining what your game is — where you’re going to have an edge — is enormously important.”

Buffett is combining two concepts: circle of competence (similar to the red zone in the image), which is where we have an informational advantage or in analysis over other investors and the Mr. Market one. The concept of Mr. Market was invented by Buffett’s teacher in Columbia University, Ben Graham, best know as the father of value investing. How does Graham explain the concept of Mr. Market? In his book, The Intelligent Investor, he mentions:

“Imagine that in some private business you own a small share that cost you $1,000. One of your partners, named Mr. Market, is very obliging indeed. Every day he tells you what he thinks your interest is worth and furthermore offer either to buy you out or to sell you an additional interest on that basis. Sometimes his idea of value appears plausible and justified by business developments and prospects as you know them. Often, on the other hand, Mr. Market lets his enthusiasm or his fears run away with him, and the value he proposes seems to you a little short of silly.

If you are a prudent investor or a sensible businessman, will you let Mr. Market’s daily communication determine your view of the value of a $1,000 interest in the enterprise? Only in case you agree with him, or in case you want to trade with him. You may be happy to sell out to him when he quotes you a ridiculously high price, and equally happy to buy from him when his price is low. But the rest of the time you will be wiser to form your own ideas of the value of your holdings, based on full report from the company about its operations and financial position.

The true investor is in that very position when he owns a listed common stock. He can take advantage of the daily market price or leave it alone, as dictated by his own judgement and inclination. He must take cognizance of important price movements, for otherwise his judgement will have nothing to work on. Basically, price fluctuations have only one significant meaning for the true investor. They provide him with an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal. At other times he will do better if he forgets about the stock market and pays attention to his dividend returns and to the operating results of his companies.”

A vital point in Graham’s message is that our notion of the intrinsic value of our investment is something that depends on the business operations and prospects, not in the market price. Having a notion of the real, intrinsic value is the weapon that we have to take advantage of Mr. Market’s suggestions. There are many ways to know the intrinsic value of a business, many of which we go over with detail in our courses. What do you think of Buffett’s and Graham’s suggestion?

2 thoughts on “Using the stock market’s mood to make money”