We recently read about Mohnish Pabrai’s addition, Graftech (EAF). While at some point we will dwell upon the sources we use for information in another post, 13-F forms are an exciting source of ideas.

With the passing of time, our investing style has evolved. When we started we looked for the cheapest companies and the numbers to back that thesis up (Tom Gayner mentions this as the search for certainty in numbers due to the lack of trust in the idea here). Therefore, we have tried investing in net-nets, low multiples, liquidation values, etc. After a while we understood that companies with moats are generally more expensive but that if one is identified, the magic of compounding intrinsic value makes one achieve good results. This is perhaps the area that suits our personality and way of looking at things best, therefore making it the one in which we allocate most of our time.

However, we believe it is vital as investors to keep expanding our knowledge and circle of competence, mostly to identify possible investment opportunities. Recently we have read more of investors such as Li Lu or Mohnish Pabrai, who recommend finding ten-baggers (or more), which are companies that are very cheap, have limited downside and an upside of many times the amount invested (basically every investor’s dream). As they mention, making money in the stock market is difficult, as we are competing against very smart people. But, every one in a while we find something that we understand, like and is interesting. That is the time to focus all of our attention to reach a decision fast.

ABefore starting with Graftech, it is important to give out three suggestions: 1) Never invest just because a famous investor has done so (they are also human: let’s remember Buffett with IBM or Ackman with Valeant); 2) it is vital to understand the business. If it is too complicated, we just move on to the next one and that’s it and 3) There is a Soda Stereo song that beings with “No hay un modo, no hay un punto exacto” (There is not a way, not an exact point), and in our view this also applies to investments in two ways: 1) there is not only one way to make money while investing, which makes sticking to only one method futile. My suggestion is to find the one that works best for us and one we feel comfortable with, but always having an open mind to new forms of seeing things and 2) intrinsic value estimates are just that: estimates.

Therefore: what did Pabrai see in Graftech?

About the company

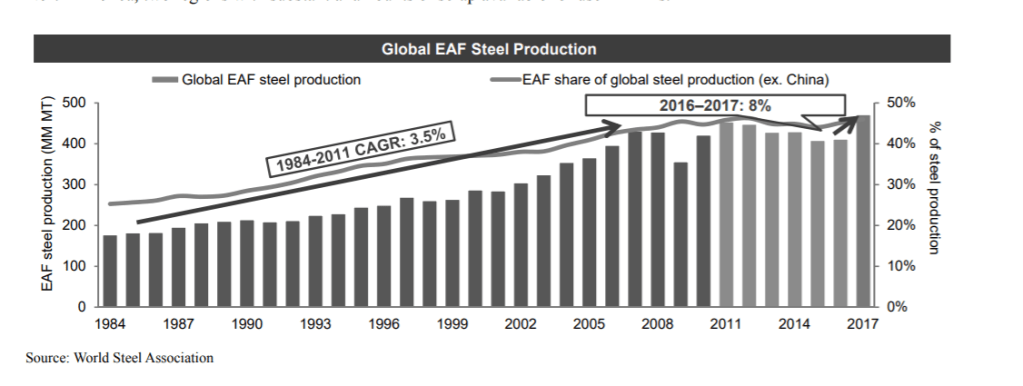

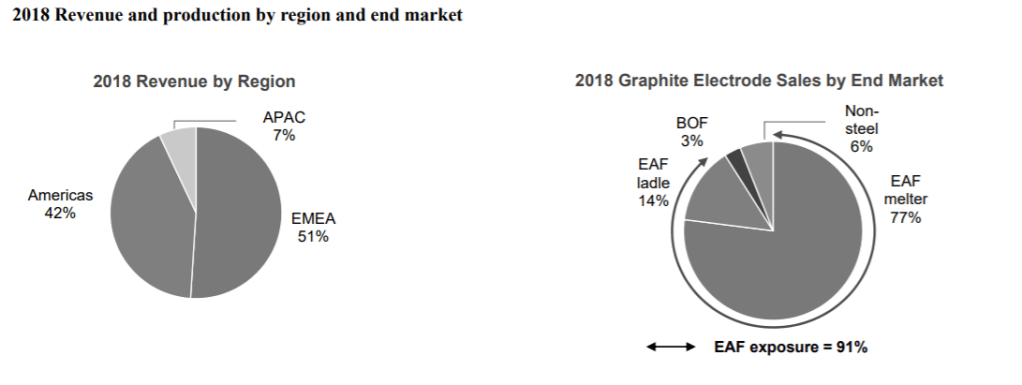

Graftech hace electrodos de grafito. Básicamente es un material (el único que se Graftech makes graphite electrodes. Basically it is a material (the only material that can handle the energy of the process) that is used to heat furnaces where steel is processed. There are two ways to process steel: the basic oxygen furnace (BOF) and electric arc furnaces (EAF). The main difference (apart from the energy source) is the type of material that they require to process steel: BOF requires as primary source iron ore, while EAF can use steel leftovers. Another difference is that capex to install a BOF plant is around US$1100 per ton, while for EAF capex is significantly less at US$300 per ton. Steel production with EAF is about 46% of total production (ex China).

Graftech specializes in producing graphite electrodes that supply necessary energy and heat to process steel at high temperatures in EAF. The company was founded in 1886 and it actually has production plants in France, Spain, Mexico and Pennsylvania.

For steel producers (EAF) the cost of graphite electrodes represent 1-5% of total production costs. Since these type of electrodes are the only ones capable of handling the temperatures and being trustworthy, producers are willing to pay up premiums for electrodes. To produce them, a needle coke is needed, which is a form of crystalline carbon. Starting in November 2010, Graftech acquired Seadrift Coke LP, which produces around 70% of their needs. Being vertically integrated allows that 1) costs to be lower and 2) Graftech has more control over production. It is important to highlight that needle coke is scarce because it is required for lithium batteries for electric cars. With Seadrift, Graftech turned into the second largest coke needle supplier in the world, with 140,000 MT in capacity, vs. the world’s largest supplier, Phillips in the United States, which as a 420,000 MT in capacity and its closest rival, Petrocokes with 95,000 MT in capacity.

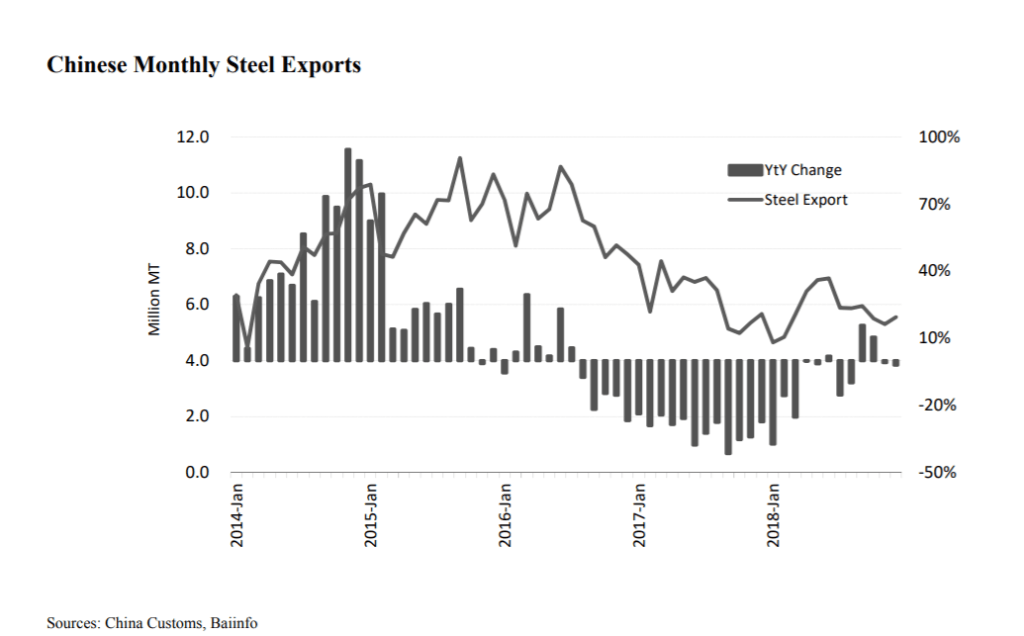

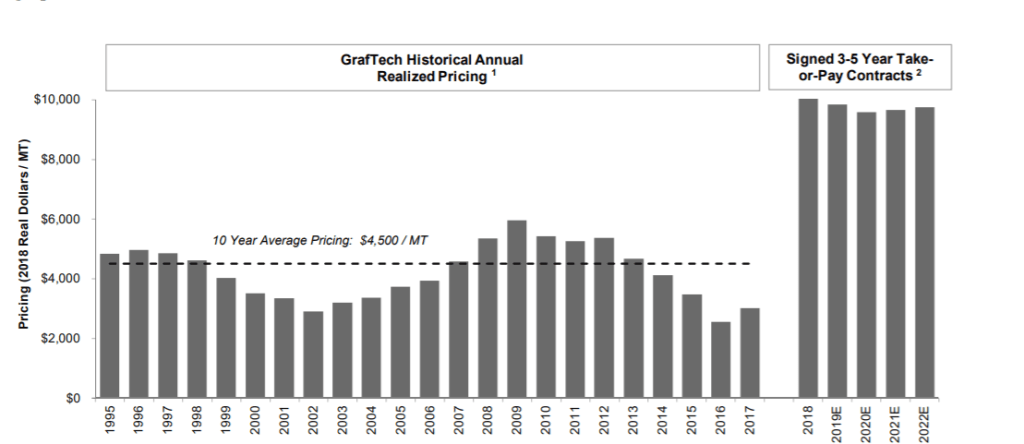

Recently, the price of graphite electrodes has increased due to three factors: 1) restriction in the production of steel (and exports from China since 2016); 2) a 20% reduction in installed capacity for the 2014-16 period (due to market conditions) and 3) and excess of recent demand.

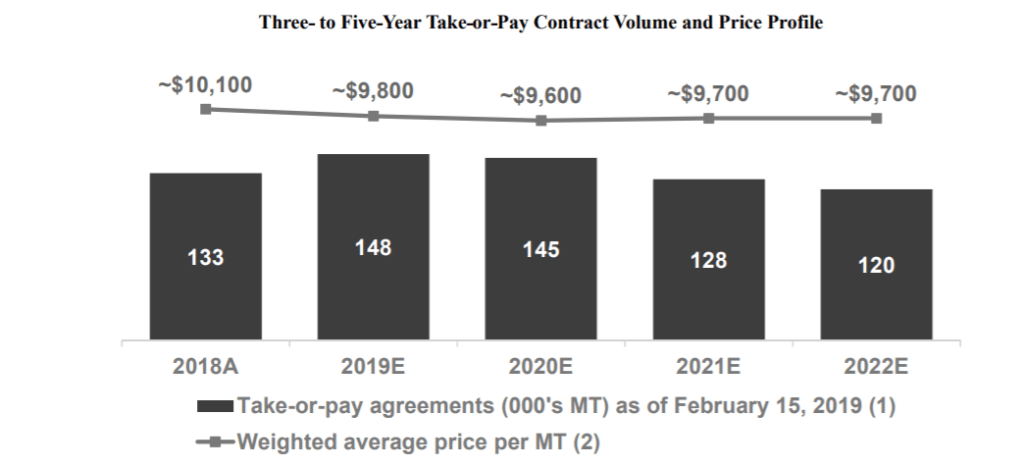

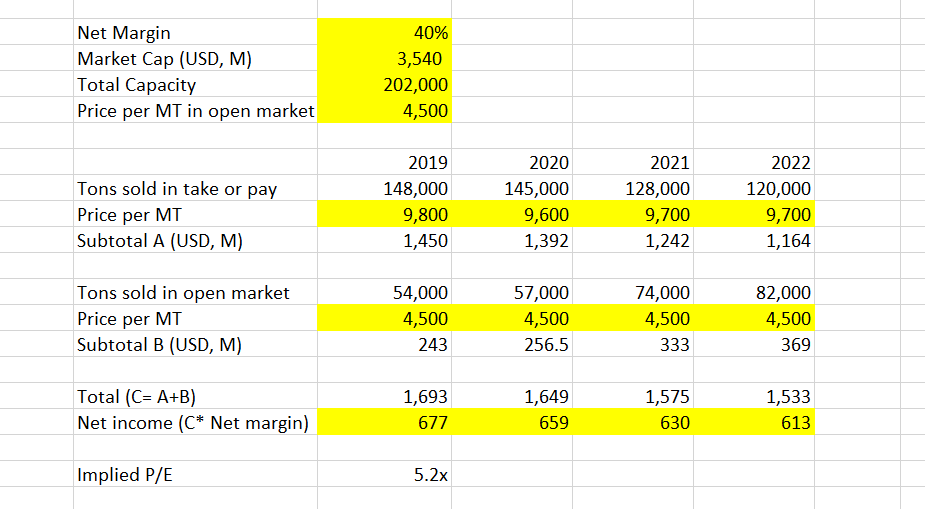

Graftech recently changed the way it conducts its business. Nowadays, it implements take-or-pay contracts, in which it establishes a price and a quantity of electrodes to deliver. In case the client does not want/cannot receive them, he must pay what was established in the contract. The average price at which contracts were signed were US$9700 per MT, and the 10-year average is US$4500. These contracts represent 65% of total sales towards 2022, the remainder of production will be sold at spot prices.

In case related-parties cannot comply with contracts, there are payments required for termination of 50-70% of the value of the contracts, and several are required to pay guarantees and collaterals.

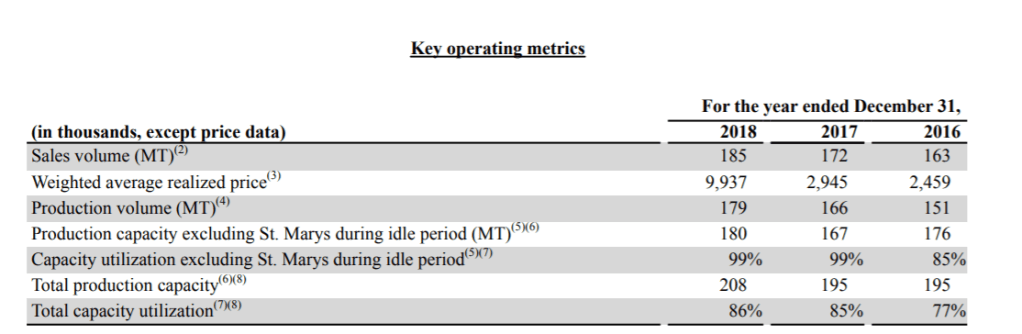

Graftech is expanding its installed capacity. It closed 2017 with a capacity to produce 167,000 MT of electrodes, while closing 2018 with 202,000 MT in capacity. In the annual report of 2018 the company mentioned there is visibility to add 28,000 MT with the St. Mary’s plant. With this, they would be close to their largest rival (ex-China, which currently has 230,000 MT in capacity). The global production capacity is estimated at 800,000MT ex China.

Over 2018, Graftech sold almost half of electrodes in EMEA, 42% in America and the remainder in APAC. Its 10 largest customers represent 38% of sales, while the next 10 represent 17%

About the structure

In 2015, Brookfield Asset Management made an offer for Graftech and turned it into a subsidiary. In April of 2018, Graftech was listed through Brookfield at US$15 per share (35M shares) and there was a follow-on for 3M shares some days later. In August of the same year, Graftech repurchased 11.6M of Brookfield shares that were cancelled after the purchase. After another follow-on, Brookfield remains the owner of 79% of the company. Something important to highlight is the leverage level of the company. In April of 2018 the company delivered a promissory note to Brookfield to pay US$750M as a dividend. During June of the same year, the company made a modification to the contract, extending the original terms for a total loan of US$250M, with which the original US$750 were liquidated. Currently, the long-term debt is at US$1991M, while accounts payable is at US$92M vs. a market cap of US$3450M.

What could Pabrai be looking at?

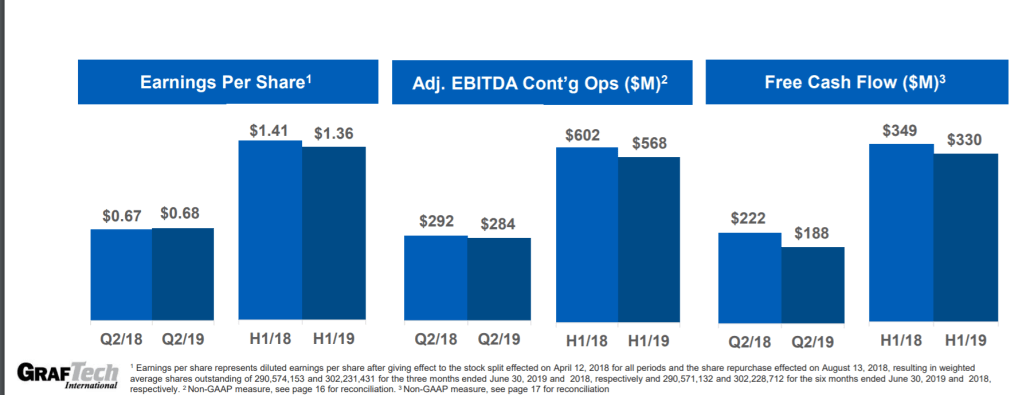

When Pabrai talks about his investment theses, he generally talks about things that with the benefit of hindsight seemed obvious. One of his suggestions (that he repeats constantly) is “Thou shalt not use Excel”. Using this mindset (and very little Excel), we believe that what Pabrai likes is the change to take-or-pay contracts, combined with an improvement in the industry dynamics that will cause a higher price for electrodes, on top of a demand with inelastic characteristics. Let’s remember that Pabrai’s strategy (detailed in The Dhandho Investor) is heads I win, tails I don’t lose much. Using the data from the annual report (and the last quarter) we can perceive that the company is trading at ~5x P/E in a very conservative scenario. What is in yellow below are our assumptions and implications. We believe that the most controversial one could be the net margin one. If we look at history, it has been very erratic, although in 2018 it reached 45%, while in 2019 it has been 41% and in 2Q19 it was 41%, we are using 40%. From what was forecasted at the end of 2018 to the current spot price, we see an interesting increase for what is sold outside take-or-pay contracts. However, we preferred to leave the 10-year average price of US$4500 per MT.

Although it is not our favorite metric (because they require more assumptions and a high FCF yield tends not to be as correlated to good performance as one may think), the company is producing good amounts of FCF. Retaining the same pace as in 2Q19, FCF yield is above 20% (annualizing the US$188M / market cap).

Where can the thesis fail?

In our view, when 65% of sales are tied to a high price, calling Graftech a commodities company is stops being 100% accurate. However, we cannot forget that the price keeps moving the needle for a high percentage of the company’s sales. We believe that the main risks are: 1) a recovery in Chinese production and therefore its exports, given that this would eliminate profitability for producers and therefore, some Graftech’s clients may not pay the contracts (or at least not in the accorded way); 2) a strong fall in electrode prices; 3) a fall in the company’s profitability; 4) that a bad financial condition translates in to a failure to comply with covenants and therefore, failure with debt payments. Probabilities of these events on an independent form are not minor, but seem low at the time. What seems interesting is that the most relevant one, which is the electrode price one, has a low impact given the take-or-pay contracts. This, in our view, provides good downside protection for Graftech and what Pabrai would call “tail, I don’t lose much”.

On the other side, we believe that being conservative, profits for 2020 at a slight multiple expansion to 7x could represent an upside of 30% with very reachable targets. Let’s not forget that electrodes do not represent much in terms of costs to producers, but they are very necessary, mostly when one with a high quality has been identified (like Graftech), making demand a bit more inelastic. Besides, we believe that having Brookfield’s backup is very important, given that it allows the management to take longer-term decisions. Overall, we believe we are in front of an asymmetrical situation with very conservative estimates and probabilities in favor of investors.