In the search of attractive investments, one of the figures that we all run into are value traps. These are investment ideas which after deep analysis appear to be worth way more than the price would indicate. After some years investing, here are some pieces of advice on how to spot them, but most importantly, how to avoid them:

- Asking, why me God? – In one of his lectures, Li Lu mentions that when we run into a company that seems to be overly cheap, it is time to ask ourselves why me, God? In a world where algorithms and computers scan and look for companies to invest without rest, why should it be me who finds such a big discrepancy between price and value? Now, this does not mean that the difference cannot exist, but it is important to identify with detail the cause of this difference to determine if it is exploitable or not. Let’s remember what Seth Klarman, one of the best investors in history, says: “You need to balance arrogance and humility…When you buy anything it’s an arrogant act. And you need the humility to say: “but I might be wrong.”

- Understanding the nature of the industry and the company’s position – There are industries in which obtaining competitive advantages and their subsequent platforms to invest at high rates of return is harder when compared to others. Here it is critical to take into account: entry barriers, type of product or service, existence of substitutes, the power of providers and users (basically Porter’s 5 forces). Another thing that we have noted is that there are cyclical companies in which an investment could bear fruit when a position is built at the bottom of the cycle (e.g. energy). There are other industries which are undergoing a secular shift like cable programming companies. In the latter case, mean reversion is more uncertain and expensive, given that companies must invest heavily to fight new entrants and/or change strategy.

- The market could be wrong and so could I – Michael Mauboussin explains that in areas like investments there could be great differences between value and price of assets, but that in general, consensus makes a good job reflecting value in prices. This connects well with point 1 and it is to remember that the market could be perceiving something that we do not. Our goal is to investigate diligently and determine if it is something that patience can solve, or that we should simply let go by. Every good business analyst is in part a detective and when we find great discrepancies between value and price a good place to start is on what the market is disliking (or liking a lot).

- Thinking of the worst scenario – Many times the market decides to pay less for some industries or companies but the company could remain looking solid and attractive. In this cases it is better to evaluate if even in the worst scenario (e.g. a strong cut in sales, profits and the company decides to pay all of its debt obligations, evaluate if there is still money for shareholders). An analysis of this type helps a lot in maintaining (above all) a margin of safety.

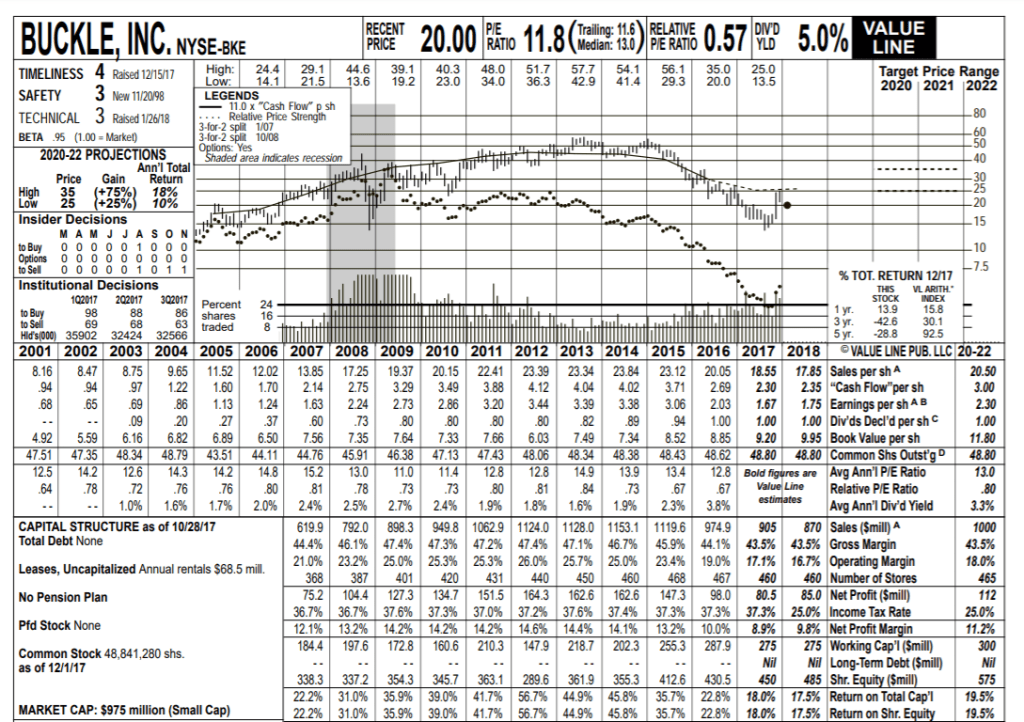

An example: The first time we interacted with Buckle (BKE), a clothing store chain in the US, was in 2014. BKE appeared in several screens even in The Magic Formula from Greenblatt. The company seemed to be doing well, revenues growing steadily, shares were being repurchased, profitability was strong and there was no debt. What happened next? Long story short, Buckle lost two thirds of its market cap. Buckle stores are located in malls mainly and in spite of the efforts to increase online sales, the high degree of competition in the sector has complicated things for BKE. Definitely, the company is well run, the balance sheet remains solid, operating and net margins are high for the industry and profitability (measured by ROE and ROIC) are impressive for a retail store. However, let’s remember that in the world of investments what matters is always the future. Positioning ourselves in 2014, we could see that sales started decreasing, so did cash flow and therefore, the value of the company started diminishing. Even in spite of the company’s multiple never surpassing 14x earnings, it is easy to see that BKE’s battle is not an easy one to win as the fight is against a secular trend: people are buying less through physical channels and more through online ones. So BKE’s alternatives for the future are hard: spend to reinvent itself or find ways to distribute capital to shareholders. As usual, the market is wondering how likely it is that the business can reinvest capital at high rates of return. In such a competitive and fragment industry as retail, the probabilities are low.

1 thought on “What is a value trap and how to avoid it”